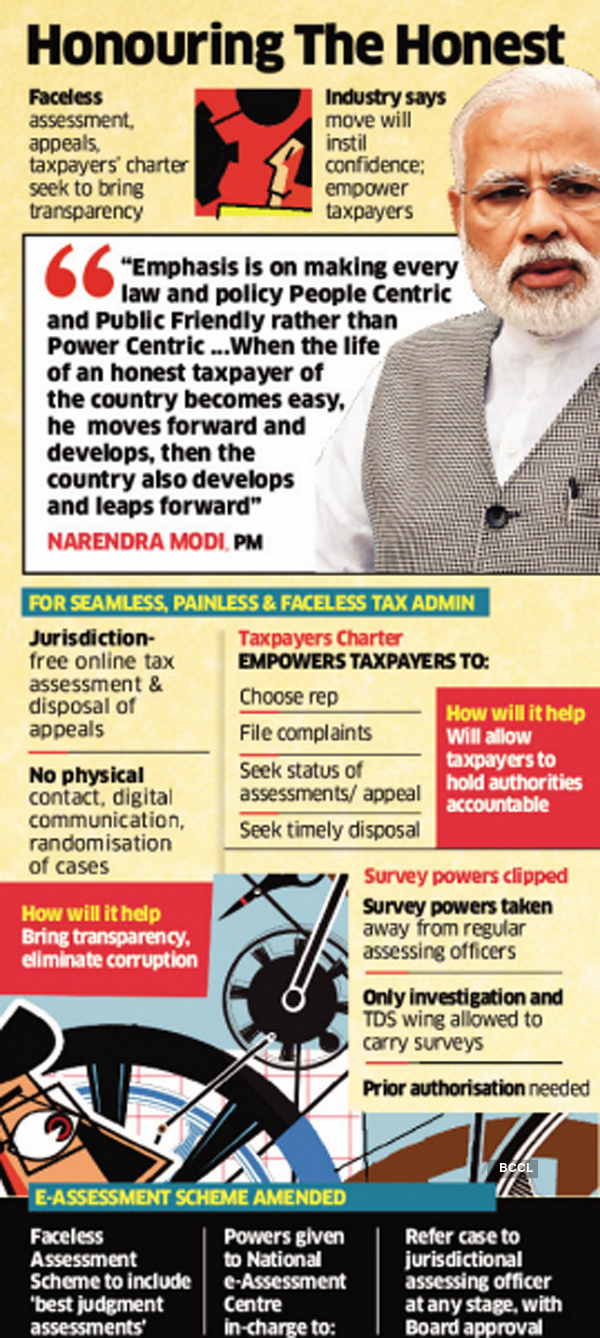

Couple of days before the 74th Independence day, our Honorable Prime Minister launched "Transparent Taxation" portal- a modern and progressive initiative for Income tax payers of the country. He appreciated the contribution of tax payers and ushered in a free, fair and respectful tax regime. PM said in his address “The new platform, apart from being faceless, is also aimed at boosting the confidence of the taxpayer and making him or her fearless,” he said. This is a welcome step that invigorates the Indian Tax payer- who are only 1% of the population.

Direct (income) Tax has its fair share in the nation building- in rolling out social welfare schemes or augmenting physical and social infrastructures, which helps mitigating the sufferings and deprivations of a sizable population of low income/ under privileged groups. An anonymous (termed as "faceless") digital scrutiny and appeal system with a charter of fair dealing is a sensitive move towards an effective and efficient tax regime which will hopefully become much more tax compliant in near future- thereby strengthening the economy and society at large.

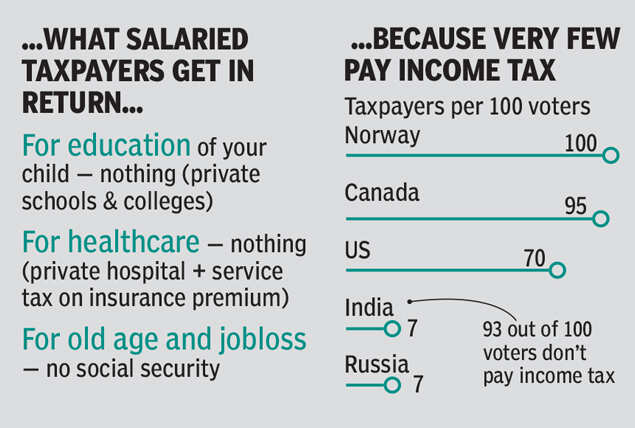

This progressive milieu gives rise to new expectations. That of inclusion of all stakeholders and accommodating all perspectives, going forward. And in that anticipation we bring to notice one such consideration here: that of a connect between taxation and welfare of taxpayer- for the private sector salaried persons and self employed professionals. While this section (they are significant percentage of total taxpayers) share over 20-30% of their income with the state, throughout the active years of their lives, they do not have any claim or entitlement of social securities at their old age or at the time of need. Govt servants- who also pay taxes- are covered with pension and health cover for self and family, so that they don't have to leave with perennial stress at their old age. Poorer citizens are covered under food security, work guarantee and health coverage even old age pension- justifiably so. The rights & entitlements to the poor are often not of desired quality or quantity but at least it shows the intent of Govt.- its commitment towards the well being of less privileged citizens. A part of this commitment is met from the tax contributions of above tax payers- employees, professionals and small businessmen & women. But the concerns of these private sector tax payers are yet to find a place in the policies of welfare and related discourses.

This anomaly is pointed out comprehensively in an article of Mr. Rohit Saran, Managing Editor of Times of India (on 30 Jan,2020). Some of his observations are as below:

1) "There are countries with income tax rates higher than India’s but taxpayers in those countries have access to services that have either never existed or have ceased to exist in India. Public education – from school to college – and public healthcare have disappeared from the lives of the urban middle class. Private expenditure on education and health in India is one of the highest in the world."

2) "Income tax payers are forced to pay for clean water, breathable air, private security and – now increasingly – road use in the form of toll. The majority of salary earners are in the private sector, and the tax they pay doesn’t entitle them to pension, unemployment support or post-retirement healthcare. The income tax for this class of people is increasingly becoming a forced charity, alienating them from the state."

3) "Countries with high income tax rates also have a much lower rate of indirect taxes than India. Prices of cars, smart TVs, smartphones, laptops are 20% to 80% lower in most countries with higher income tax rates. A back-of-the envelope calculation shows that the buyer of a mid-level car in India has to pay 58% of his total expenses to government. If he meets with an accident, government is unlikely to bear the cost of his treatment or provide income support if he loses his job."

Saran further observes that "One possible reason income taxpayers are uncared for is that they don’t matter as voters. Only 7% of Indian voters pay income tax. In Norway, 100% and in the US 70% voters are income taxpayers."

No comments:

Post a Comment